The landscape of the fast-growing financial services industry in Bangladesh is rapidly changing due to the increasing intervention of advanced technology and the level of interconnectedness with the global markets. Across all types of financial and non-financial organizations, analytical skills and mindset are key, and Bangladesh is not an exception. In particular, continued innovations in financial products, services, and processes in Bangladesh require the application of state-of-the-art technical skills combined with a strong knowledge base in the broad areas of Finance. The requirement can be largely met by applying the advanced analytical features of Microsoft Excel in the broad areas of Finance. MS Excel is one of the most powerful software, which offers a large number of highly impactful analytical and intelligence tools with wide flexibility. As a result, in any financial institution (e.g., banks and NBFIs, stockbrokers and dealers, and merchant banks), the demand for advanced level expertise in financial applications of MS Excel is high and ever increasing.

The aim of this Certification is to deliver comprehensive and advanced level knowledge and skills in Finance. The Certification is open to all – professionals or students, finance or non-finance professionals.

In general, with the advancement of technology in Bangladesh’s financial market, financial analytics becomes a fundamental skill required in the financial services industry.

- The Certification will be useful for fresh graduates to enter the job market or begin a profession in Finance with advanced expertise in financial modeling and valuation using MS Excel.

- Working professionals related to the finance-related fields will be able to use the Certification to upgrade their skill set and grow their careers.

- This Certification could be a pivotal and fundamental qualification in obtaining a Research Analyst license from the Bangladesh Securities and Exchange Commission.

- The Certification could help in starting or progressing a career in the following types of institutions where financial analytics plays a pivotal role: Banks, Insurance companies, Leasing companies, Finance companies, Merchant banks, Asset Management Companies, Brokerage firms, Credit rating companies, Research firms, Consulting firms, and State-owned enterprises.

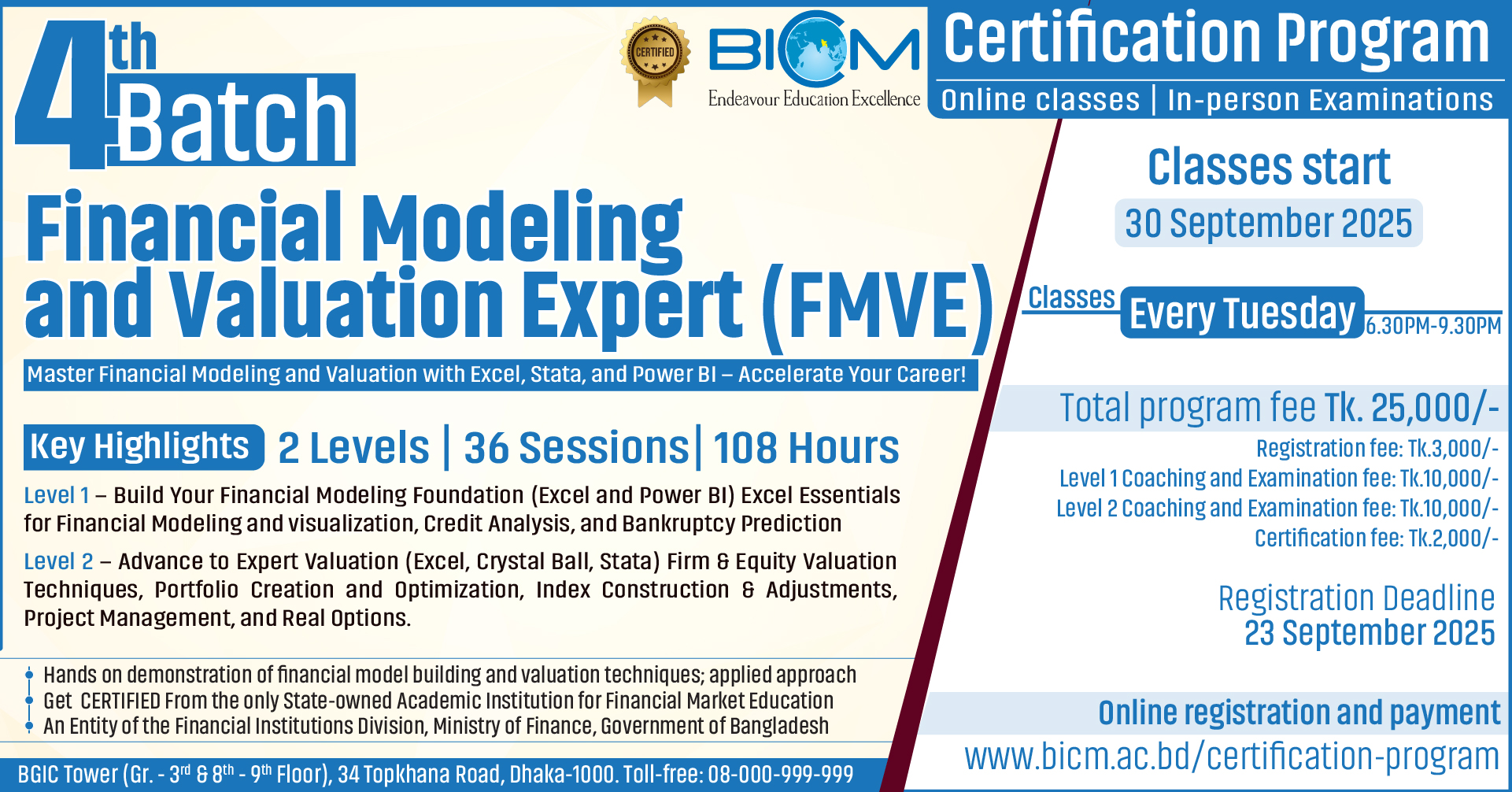

2 LEVELS; 12 MODULES; 108 HOURS OF LEARNING; FINISH ANYTIME IN 3 YEARS

Prep courses (only if required)

- FMVE 089: Accounting fundamentals, principles and standards

- FMVE 090: Introduction to MS Excel

- FMVE 091: Principles of Finance

- FMVE 093: Fundamentals of Financial Management

- FMVE 095: Fundamentals of Statistics

- FMVE 097: Principles of Economics

- FMVE 099: Security Analysis and Portfolio Management

Level 1:

Level 1 certification includes completion of the following core modules:

- FMVE 102: Understanding the usability of MS Excel features for FMVE

- FMVE 104: Using Pivot and Dashboard for decision making in excel and Power BI

- FMVE 106: Building interactive and sensitive 4-statement financial models

- FMVE 108: Developing projected financial statements

- FMVE 110: Building ratio analysis, trend analysis, common sizing, and break-even analysis models

- FMVE 112: Building credit analysis, credit rating, and corporate bankruptcy prediction models

Level 2:

Level 2 certification includes completion of the following core modules:

- FMVE 202: Firm and equity valuation using multiple and market based models

- FMVE 204: Firm and equity valuation using DCF with real options and risk

- FMVE 206: Sensitivity, scenario, and simulation analysis in financial models

- FMVE 208: Securities Analysis, Portfolio Construction, and Portfolio Optimization

- FMVE 210: Constructing stock market index, index maintenance and update, index review, and corporate event adjustments

- FMVE 212: Project evaluation and capital budgeting decisions, real option valuation, and sensitivity and scenario Analysis

- Certification issued by BICM – the country’s only state-owned academic institute for the financial market

- Designed for all – students and professionals from finance or non-finance background may join

- Preparatory courses for participants who need remedial knowledge in Finance

- Levels 1 and 2 may be completed separately anytime within 3-year registration validity

- Become an FMVE in one year if you take up Levels 1 and 2 consecutively

- 108 hours of learning sessions and 2 examination sessions in a year

- Sessions delivered by high-experienced trainers and experts

- Registration fee (One time) – Tk. 3,000/-

- Level 1 coaching and examinations fee (Every term attempted) – Tk. 10,000/-

- Level 2 coaching and examination fee (Every term attempted) – Tk. 10,000/-

- Certificate fee (One time) – Tk. 2,000/-

- Certification renewal fee – Tk. 5,000/- per renewal

- Prep course fee – Tk. 1,000/- per course, not exceeding Tk. 5,000/- in total for any number of prep courses taken.

- Examination retake fee – Tk. 2,000/-

Sign-up or log-in to www.bicm.ac.bd and browse to the Certification Program panel. Click on 'Enroll Now' button and proceed with registration.

N.B.: Initially, you just need to pay the registration fee of Tk.3,000/-. Upon scrutinizing your credentials, you will be communicated for further payment of Level 1 Coaching and Examination fee or prep-course fee, as applicable.

For queries and support

01572-112496, 08-000-999-999 (Toll-Free)

imran@bicm.ac.bd